New Paragraph

DO YOU REMEMBER MAY 1978

If you attended high school in 1978, you are likely nearing age 65, the point at which you will start making decisions about your Medicare options.

To learn more about your options, give me a call to schedule a no-cost, no-obligation informational meeting.

In the meantime, enjoy recalling these memories from May 1978:

Top 5 Singles – May 13, 1978

#1 “If I Can’t Have You” – Yvonne Elliman

#2 “The Closer I Get to You” – Roberta Flack with Donny Hathaway

#3 “With a Little Luck” – Wings

#4 “Too Much, Too Little, Too Late” – Johnny Mathis / Denise Williams

#5 “Night Fever” – The Bee Gees

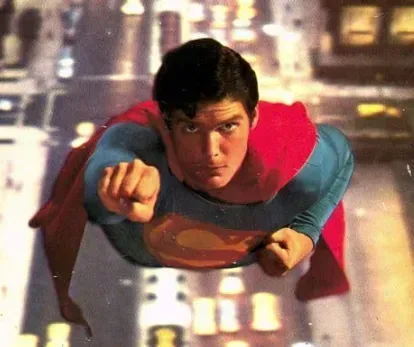

Top-Grossing Movie Week of May 10

“F.I.S.T.”

May 1978 Events

• The first use of an electronic messaging system to send an unsolicited message to a large number of recipients for the purpose of commercial advertising, now commonly called spamming, was made when a representative of Digital Equipment Corporation (DEC), Gary Thuerk, sent the same message, simultaneously, to 393 users of ARPANET, the Advanced Research Projects Agency Network

• Ben Cohen and Jerry Greenfield, both natives of Merrick, New York, who had completed a correspondence course on ice cream making, opened an ice cream parlor in Burlington, Vermont, with an investment of $12,000, creating Ben & Jerry’s.

• The National Oceanic and Atmospheric Administration (NOAA), the U.S. agency in charge of meteorology, announced it would end the practice of solely using female names for storms and hurricanes. After Tropical Storm “Aletta,” the next storm was identified as “Bud.”

• Charlie Chaplin’s coffin was found buried 2 feet deep in a cornfield 9.3 miles from the Swiss cemetery from which it was stolen more than two months earlier.

• At the age of 53, Mavis Hutchinson of South Africa, referred to in the press as “The Galloping Granny,” became the first woman to run across the continental United States as she arrived in front of New York City Hall.

• The first legal gambling casino in the eastern United States opened at

10 a.m. in Atlantic City.

• Al Unser won the Indianapolis 500, finishing eight seconds ahead of Tom Sneva.

• The price of mailing a letter in the United States increased from 13 cents to 15 cents.

—Source: Wikipedia

FEATURED